An Unbiased View of A&a Works

An Unbiased View of A&a Works

Blog Article

Getting The A&a Works To Work

Table of ContentsThe 45-Second Trick For A&a WorksNot known Details About A&a Works A&a Works Things To Know Before You BuyExcitement About A&a WorksThe Of A&a WorksThe Ultimate Guide To A&a Works

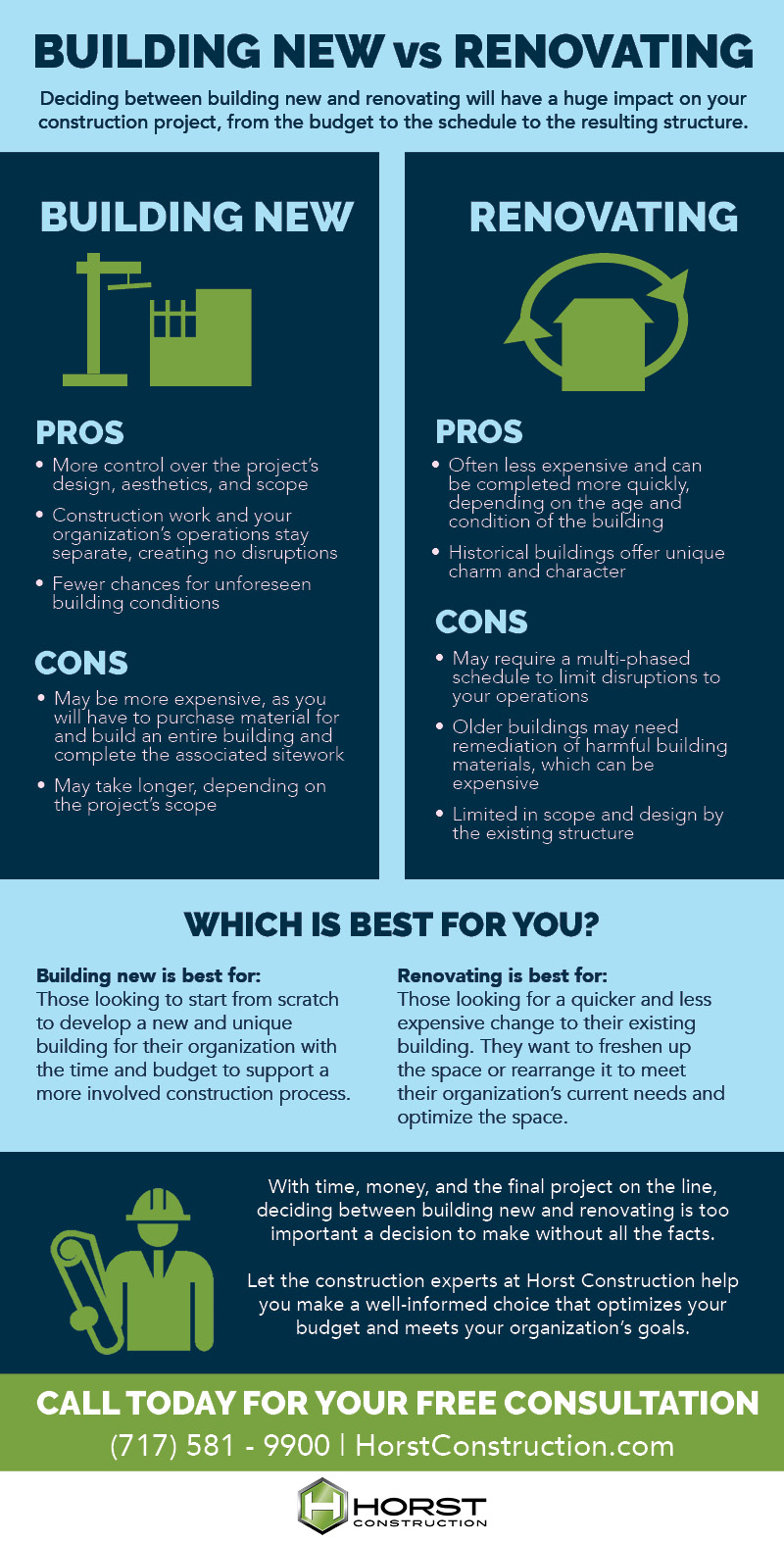

There are multiple restoration finance alternatives for individuals that intend to obtain cash to boost or restore their home. Loans that use your home as security, including home equity lendings and HELOCs, can have tax benefits. Finances that do not rely on home equity are likewise a choice, but normally have higher rates of interest.

Whether you're seeking to remodel your cooking area, mount an office or complete your basement, any kind of significant home improvement is going to need some major money. A home improvement lending can be your path to obtaining the job underway quicker than you think (A&A Works). This overview lays out funding options for your home upgrades and exactly how to obtain a restoration funding

There are several scenarios where you might intend to consider this finance type: Your home needs an urgent fixing (a pipes concern, for instance) or gets on the brink of one (sinking foundation) and you do not have the cash money accessible to pay a specialist. Or, it's an optional task, yet you do not intend to blow the budget or deplete the interest-bearing account for it.

The Main Principles Of A&a Works

One vital means to boost the worth of your ownership risk in your home (besides paying down your home mortgage) is to boost the home itself. Strategically-selected renovations can be a wise investment, boosting your residential property value and making your home a much more comfortable place to live. If you are looking to list your home, nothing includes an open market edge like tasks that increase the habitable area or keep the home up-to-date and useful.

Before applying for any kind of funding, bear in mind that your credit score plays a crucial function in locking in the least expensive passion rate. If you have time, think about taking actions to improve your score by paying for charge card bills and making all payments promptly. Is this a do it yourself work or will you require specialists and if so, what will your labor costs be, in addition to materials? Will you need to rent a place to live somewhere else while the task is happening? Created a comprehensive budget.

By doing this, the funding is an investment that might increase the home's worth. You can qualify with a down payment as low as 3 percent if you're a first-time customer getting a fixed-rate funding and you intend to stay in the home. It may include reduced rate of interest and much shorter repayment terms than standard enhancement lendings.

Fees and closing expenses might be more than other kinds of mortgage. However, through Fannie Mae's Neighborhood Secs program, you may be able to obtain approximately 5 percent of your home's worth to assist cover the down repayment and closing expenses. Caret Down In an affordable property market, a Fannie Mae HomeStyle Improvement financing might not be excellent if you're looking to protect a bargain quick.

3 Simple Techniques For A&a Works

Your professional has to develop a construction routine and plans for your remodelling. You need to additionally submit a residential property evaluation understood as go right here an "as-completed" appraisal. Like the Fannie Mae HomeStyle Remodelling loan, the FHA 203(k) loan a government-backed conventional rehabilitation loan funds the home acquisition and its remodellings. The Federal Housing Management guarantees this finance, and its objective is to create more alternatives for property owners or buyers of homes that require rehab and repair.

You might be eligible for a larger tax reduction (the larger funding combines improvement and home purchase). Any makeover is restricted to the FHA's checklist of qualified projects.

The finance is additionally only for key homes, not second homes or getaway residences.

The A&a Works Statements

Home equity fundings included fixed passion rates and repayment amounts that stay the very same for the life of the finance. With a HELOC, you can attract funds as you need and only pay interest on what you draw. You might have the ability to deduct the interest if you itemize on your income tax return.

You can't attract funds only as needed with home equity finances as you can with HELOCs. Rate of interest are variable with HELOCs, which indicates your price and repayment can increase. Certifications may be more rigid: You need to have and keep a particular amount of home equity. Caret Down Closing expenses vary from 2 percent to 5 percent of the loan amount.

An Unbiased View of A&a Works

A cash-out refinance can have the double advantage of letting you refinance a higher-rate home loan to one with a reduced rate while taking out cash money to spruce up your building. A refinance jobs well if you can get a lower passion price than the one on your present mortgage. A lower price and a rise in home worth as a result of improvements are wonderful lasting advantages.

You may have the ability to obtain a lower rate of interest or transform your funding term. The cash-out is consisted of in the new home mortgage, so there are no different repayments to make. A section of the cash-out rate of interest might be tax-deductible. Caret Down You must use your home find more info as collateral. You have to contend the very least 20 percent equity in your home to be eligible.

The smart Trick of A&a Works That Nobody is Discussing

You can combine financial debt from multiple high-interest charge card into one finance with reduced rate of interest. You can obtain financing as quick as the same day or the following company day. A lot of personal finances are unsecured, implying you won't have to use your home as security. Caret Down They commonly have higher interest rates than home equity financings and HELOCS and cash-out refis (since the financing is unsafe).

Personal lendings also provide the debtor great deals of freedom regarding the sort of enhancements that they can make. Lenders likewise have a lot of flexibility pertaining to the amount of interest they can bill you. Put simply, if you're borrowing money at a 25 percent rate of interest, you're mosting likely to pay even more than could be necessary to complete your project.

Do not let your upgrade come with any of these drawbacks: Are you planning on marketing this home in the close to future? When taking into consideration renovations, maintain in mind that the overall price will most likely entail more than just labor and products.

Report this page